Zombie debt is debt that has been “raised from the dead,” so to speak. It could even be something you never owed at all.

When a person doesn’t pay a debt, the lender will take action – by phone, letter, or even a court case – to collect the money they are owed. In some cases, though, the debtor simply can’t pay or can’t be found. In other cases, the debtor files for bankruptcy and, depending on the kind of debt owed, the debt may be put on hold, renegotiated or discharged completely.

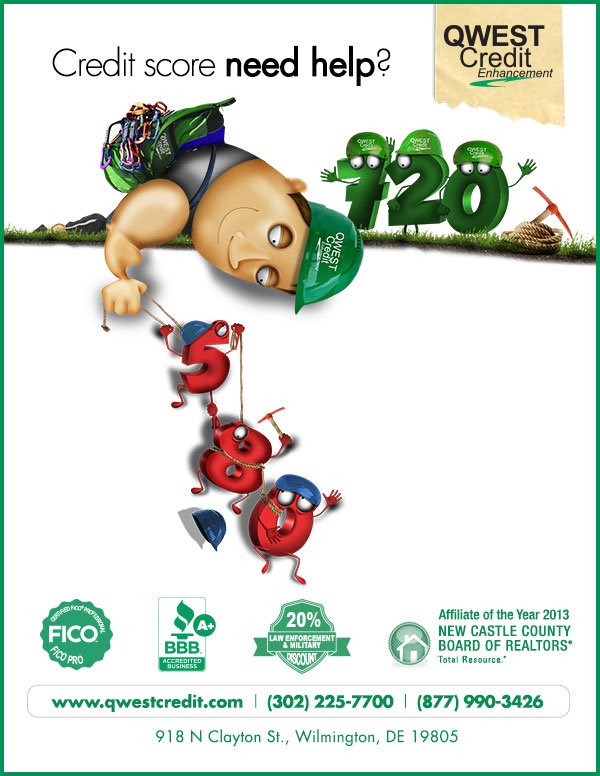

from Qwest Credit Enhancement Blog https://ift.tt/31WCcUm

via IFTTT